Botswana: ITW7a Changes

Following the increase in the tax exemption from one third to 50% for certain lumpsums received by an employee effective 15 January 2024, the BURS has made updates to the Monthly PAYE Return Schedule ITW7A. This change is effective as from 01 July 2024.

Taxpayers are instructed to use the new CSV file for the 2025 tax year (July 2024 – June 2025) submissions.

Please Note:

We encourage you to re-upload for the periods from July 2024 that have been submitted on the old layout. If you need to revise a return and it falls within period 01/2024 to 06/2024, you must use the old CSV.

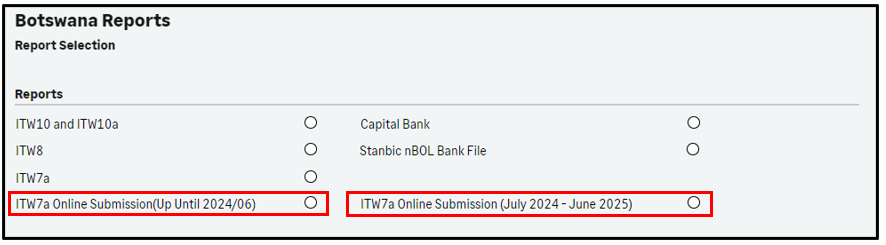

We have amended the ITW7a Online Submission found on the Botswana Reports Screen:

The ITW7a Online Submission has been renamed to ITW7a Online Submission (Up until 2024/06).

If you need to revise a return and it falls within period 01/2024 to 06/2024, you must print this report that makes use of the old CSV layout.

Please Note:

The selections made on the <Report Setup> for this report are automatically replicated on the ITW7a Online Submission (July 2024 - June 2025) Report.

You are encouraged to print this new report, ITW7a Online Submission (July 2024 - June 2025), which makes use of the new CSV layout, to re-upload for the periods from July 2024 that have already been submitted on the old layout.

This is the report you must use for the rest of the Tax Year.

Please Note:

The selections made on the <Report Setup> for this report are automatically replicated on the ITW7a Online Submission (Up Until 2024/06) Report.

The following new fields have been added to the CSV File:

|

Field Description |

Details |

|

SeverancePayGratuityPaymentDate |

Severance Pay /Gratuity Payment Date will be the Period End Date if a value exists for selection field Severance Pay (Column L). The field is unprotected and can be edited by you. |

|

RetrenchmentPaymentDate |

Retrenchment Payment Date will be the Period End Date if a value exists for selection field Retrenchment Package (Column O). The field is unprotected and can be edited by you. |

|

PensionCashout |

Pension Cash Out is not applicable to ordinary employers, but it is applicable to pension fund administrators to report on fund members. Therefore, we do not populate this field. |

|

PensionTotalFund |

Pension Total Fund is not applicable to ordinary employers, but it is applicable to pension fund administrators to report on fund members. Therefore, we do not populate this field. |

|

PensionPaymentDate |

Pension Payment Date is not applicable to ordinary employers, but it is applicable to pension fund administrators to report on fund members. Therefore, we do not populate this field. |